Mục lục

Understanding the real estate market is essential for real estate professionals, investors, and anyone looking to buy or sell property. Here are details and insights to help you understand the real estate market:

- Market Dynamics: The real estate market is influenced by supply and demand dynamics. When there are more buyers than available properties, it’s a seller’s market, leading to higher prices. Conversely, when there are more properties for sale than buyers, it’s a buyer’s market, potentially leading to lower prices.

- Location Matters: Real estate is highly location-specific. Property values, rental income potential, and market conditions can vary significantly from one neighborhood to another, even within the same city.

- Property Types: Different property types, such as residential, commercial, industrial, and land, have distinct market dynamics and investment potentials. Understanding the nuances of each property type is crucial.

- Local Economic Factors: Local economic factors, such as job growth, population trends, and industry developments, play a significant role in shaping the real estate market. A thriving local economy can boost demand for properties.

- Interest Rates: Mortgage interest rates affect both homebuyers and property investors. Lower interest rates often lead to increased demand, as borrowing becomes more affordable.

- Property Condition: The condition of a property, including its age, maintenance, and renovations, can significantly impact its market value and desirability.

- Market Cycles: Real estate markets go through cycles, including boom, stability, and recession phases. Understanding where a market is in its cycle can inform investment decisions.

- Market Research: Conduct thorough market research to assess property values, rental rates, and recent sales in the area. Online resources, local real estate associations, and government agencies often provide market data.

- Property History: Investigate a property’s history, including past sales, price changes, and any known issues. This information can help you gauge its value and potential.

- Legal and Regulatory Considerations: Different regions have varying zoning laws, building codes, and property tax rates. Familiarize yourself with local regulations that may impact property use and ownership costs.

- Real Estate Professionals: Real estate agents, appraisers, and property managers have valuable knowledge of local markets. Consulting with these professionals can provide insights and expertise.

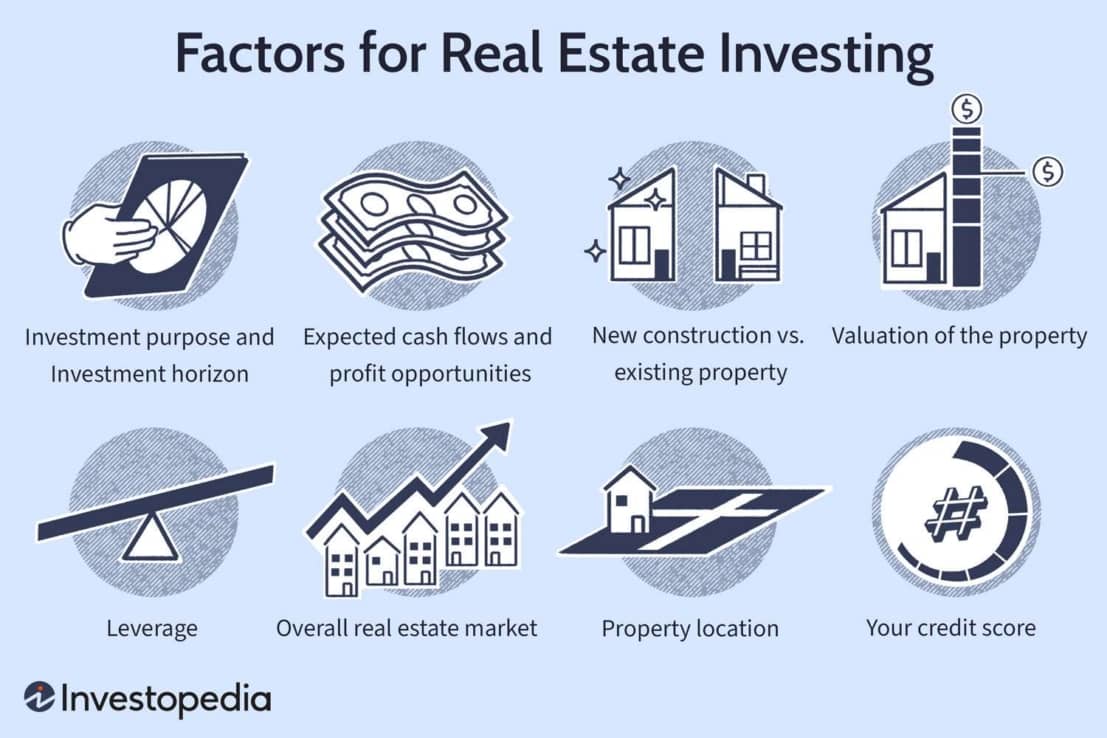

- Investment Strategy: Determine your real estate investment strategy, whether it’s buying and holding for rental income, flipping properties for quick profits, or other approaches. Your strategy should align with your financial goals and risk tolerance.

- Financial Analysis: Conduct financial analysis to evaluate the potential return on investment (ROI) for a property. Consider factors like cash flow, appreciation potential, and associated costs.

- Market Trends: Stay informed about current market trends, such as the rise of remote work affecting housing preferences or sustainability becoming a key consideration in property values.

- Network: Building a network of industry professionals, fellow investors, and local contacts can provide valuable market insights and opportunities.

Understanding the real estate market is an ongoing process. Continuous learning, staying updated on market conditions, and adapting to changing trends are key to success in the real estate industry. Whether you’re buying, selling, or investing, a solid understanding of the market is essential for making informed decisions.

Market Dynamics:

Market dynamics refer to the forces and factors that influence the behavior of a market, including supply and demand, pricing, competition, and consumer behavior. These dynamics are essential for businesses, investors, policymakers, and researchers to understand and navigate the marketplace effectively. Here are details and insights into market dynamics:

- Supply and Demand: Supply represents the quantity of a product or service available in the market, while demand is the quantity consumers are willing to purchase at various price levels. An imbalance between supply and demand can lead to price fluctuations and affect market dynamics.

- Price Elasticity: Price elasticity measures how sensitive demand is to changes in price. Products or services with elastic demand experience significant changes in demand in response to price changes, while inelastic demand is less responsive.

- Competition: The level of competition in a market can influence pricing, quality, and consumer choices. High competition can lead to lower prices and innovations as businesses strive to gain a competitive edge.

- Market Structure: Market dynamics can vary based on the market structure, which can be perfectly competitive, monopolistic, oligopolistic, or monopolistic competitive. Each structure has its own characteristics and dynamics.

- Consumer Behavior: Consumer preferences, trends, and buying habits can significantly impact market dynamics. Businesses must adapt to changing consumer behavior to remain competitive.

- Government Regulations: Government policies and regulations, including taxes, trade restrictions, and industry-specific rules, can shape market dynamics by influencing prices, competition, and consumer choices.

- Technological Advancements: Technological innovations can disrupt markets by introducing new products, services, and business models, altering the competitive landscape and consumer behavior.

- Economic Conditions: Broader economic factors, such as inflation, interest rates, unemployment, and economic growth, can influence consumer spending, investment, and market stability.

- Globalization: Markets are increasingly interconnected on a global scale, with international trade, supply chains, and competition affecting market dynamics.

- Market Research: Data and market research provide insights into consumer behavior, market trends, and competitors’ strategies. Businesses use this information to make informed decisions and adapt to market changes.

- Environmental and Social Factors: Growing awareness of environmental and social issues can influence consumer preferences, leading to demand for sustainable products, ethical practices, and corporate social responsibility.

- Market Entry and Exit: Barriers to entry, including capital requirements, regulatory hurdles, and economies of scale, can impact market dynamics by limiting or enabling new businesses to enter.

- Global Events: Events such as economic crises, natural disasters, and pandemics can have profound and unpredictable effects on market dynamics, disrupting supply chains and demand patterns.

- Market Segmentation: Markets are often segmented based on demographics, psychographics, geographic location, or behavior. Understanding market segments helps businesses tailor their strategies to specific customer groups.

- Network Effects: Some markets exhibit network effects, where the value of a product or service increases as more people use it. This dynamic can lead to rapid growth and market dominance for certain businesses.

Understanding market dynamics is an ongoing process that involves continuous monitoring, analysis, and adaptation to changes in the marketplace. It is essential for businesses to respond effectively to market shifts, capitalize on opportunities, and mitigate risks in a competitive and ever-changing environment.

Location Matters:

“Location matters” is a fundamental concept in real estate that emphasizes the significance of a property’s geographic location in determining its value, desirability, and suitability for various purposes. Here are details and insights about why location matters in real estate:

- Property Value: The location of a property is one of the most influential factors in determining its market value. Desirable neighborhoods, proximity to essential amenities, and accessibility to transportation hubs can significantly increase property values.

- Neighborhood Characteristics: Different neighborhoods within a city or region can have distinct characteristics that attract specific demographics. These may include factors like safety, school quality, parks, shopping districts, and cultural amenities.

- School Districts: The quality of local schools can greatly impact property values. Homes in highly rated school districts often command higher prices, as families are willing to pay a premium for access to good education.

- Safety and Crime Rates: Low crime rates and a sense of safety are important factors for both homeowners and renters. Properties in safe neighborhoods tend to be more appealing and valuable.

- Proximity to Employment Centers: Being close to major employment centers, business districts, or job hubs can be a major selling point. Short commutes are highly desirable for many buyers and renters.

- Accessibility: Easy access to highways, public transportation, and airports is valuable for both residential and commercial properties. Convenient transportation options can enhance property value and desirability.

- Amenities and Services: The presence of amenities such as hospitals, shopping centers, restaurants, and recreational facilities can significantly enhance a location’s appeal.

- Natural Environment: Proximity to natural attractions like parks, waterfronts, and scenic views can increase property values. Properties with pleasant natural surroundings are often sought after.

- Future Development: Being in an area with planned or ongoing development projects, such as infrastructure improvements or new business developments, can boost property values as it indicates growth and increased economic activity.

- Local Regulations: Zoning regulations and land use policies can affect property values by determining what types of structures can be built in an area. For example, zoning for residential vs. commercial use can impact a property’s value.

- Historical Significance: Historical districts or properties with historical significance may attract buyers or tenants interested in preserving or living in historically rich environments.

- Cultural and Entertainment Opportunities: Proximity to cultural attractions, entertainment venues, theaters, and nightlife can make a location more appealing, particularly in urban areas.

- Micro-Markets: Real estate markets can vary significantly within a city or region. Even neighboring neighborhoods may have different property values and dynamics, emphasizing the importance of micro-market analysis.

- Resale Value: Consideration of location is essential not only for your immediate needs but also for potential resale value. Properties in desirable locations tend to appreciate better over time.

- Investment Potential: Investors often prioritize location when evaluating properties. They seek areas with strong growth potential and demand for rental properties.

Understanding that “location matters” is crucial for anyone involved in real estate, whether buying, selling, investing, or developing properties. A property’s location can ultimately determine its long-term value and suitability for specific purposes, making it one of the most critical factors in real estate decision-making.

Property Types:

Property types in the real estate market refer to the various categories of real estate assets that can be bought, sold, or invested in. Each property type has its characteristics, uses, and investment considerations. Here are details and insights into common property types:

- Residential Properties:

- Single-Family Homes: Detached houses designed for one family. They offer privacy and often come with yards.

- Condominiums (Condos): Individual units within a larger complex. Condo owners own their unit but share common areas with other residents.

- Apartments: Multi-unit buildings where units are rented to tenants. Investors can own and rent out entire apartment buildings.

- Townhouses: Similar to single-family homes but typically connected to neighboring units, sharing walls.

- Commercial Properties:

- Office Buildings: Designed for business operations, including offices for various companies. Classifications include Class A (high-quality, well-located), Class B (average quality), and Class C (lower quality).

- Retail Properties: Locations for retail businesses, such as shopping malls, strip malls, and standalone stores.

- Industrial Properties: Facilities for manufacturing, warehousing, distribution, and logistics. Types include warehouses, factories, and distribution centers.

- Hotels and Hospitality: Properties designed for short-term lodging, including hotels, motels, resorts, and vacation rentals.

- Mixed-Use Developments: Properties that combine two or more uses, such as residential units above retail spaces.

- Land:

- Undeveloped Land: Raw, vacant land that has not been developed for any specific purpose. Investors may buy land for future development.

- Agricultural Land: Used for farming and agricultural purposes. It can be bought for farming, investment, or development.

- Commercial Land: Land zoned for commercial use but not yet developed. It’s often purchased by developers for future commercial projects.

- Residential Land: Land designated for residential development, including subdivisions and housing developments.

- Specialty Properties:

- Healthcare Facilities: Properties like hospitals, clinics, nursing homes, and medical office buildings catering to healthcare services.

- Educational Facilities: Properties used for education, such as schools, colleges, and training centers.

- Religious Properties: Churches, temples, mosques, and other religious buildings.

- Government Properties: Government-owned buildings, including courthouses, post offices, and government offices.

- Recreational Properties: Properties for sports and recreation, such as sports stadiums, golf courses, and amusement parks.

- Investment Properties:

- Rental Properties: Properties purchased for generating rental income. These can include residential or commercial properties.

- Vacation Rentals: Properties bought for short-term vacation stays and often managed by vacation rental companies.

- Real Estate Investment Trusts (REITs): Investment in a portfolio of real estate assets through publicly traded securities.

- Mixed-Use Properties:

- Combination of Uses: Properties with a mix of residential, commercial, and/or other uses in a single development.

- Special-Use Properties:

- Historic Properties: Buildings with historical significance and preservation restrictions.

- Eco-Friendly Properties: Environmentally sustainable and green buildings designed to minimize their ecological impact.

- Special-Purpose Properties: Properties designed for a specific purpose, such as data centers, movie theaters, or self-storage facilities.

- Luxury Properties:

- High-End Residences: Premium residential properties known for luxury features, high-quality materials, and desirable locations.

- Luxury Hotels and Resorts: High-end accommodations offering luxury amenities and services.

Each property type comes with its own set of advantages, risks, and market dynamics. Investors and real estate professionals carefully assess the property type and local market conditions to make informed decisions based on their investment goals and risk tolerance. Understanding the nuances of each property type is essential for success in the real estate market.

Local Economic Factors:

Local economic factors play a crucial role in shaping the dynamics of a real estate market. These factors can significantly impact property values, demand, and investment opportunities in a particular area. Here are details and insights into the influence of local economic factors on the real estate market:

- Job Market: The strength and stability of the local job market are key drivers of real estate demand. Areas with diverse industries, low unemployment rates, and job growth tend to attract more residents and businesses, boosting the demand for housing and commercial properties.

- Industry Presence: The types of industries in an area can have a profound impact on the real estate market. For example, tech hubs tend to drive demand for housing and office spaces, while manufacturing areas may have different property needs.

- Income Levels: The average income levels of residents in a locality can affect the affordability of housing. Areas with higher average incomes can support higher property values and rental rates.

- Population Growth: Rapid population growth can increase demand for housing, leading to rising property prices. Conversely, areas with declining populations may experience reduced demand and stagnant property values.

- Education Institutions: The presence of well-regarded educational institutions, including schools, colleges, and universities, can attract families and students, influencing both the rental and housing markets.

- Infrastructure Investment: Public and private investments in infrastructure, such as transportation networks, airports, and public amenities, can enhance a region’s appeal and stimulate property development.

- Business Environment: A favorable business environment, characterized by low taxes, business-friendly regulations, and incentives for entrepreneurship, can attract companies and investors, leading to increased demand for commercial real estate.

- Tourism and Hospitality: Areas with strong tourism industries can experience heightened demand for hotels, vacation rentals, and recreational properties.

- Quality of Life: Factors like the availability of parks, cultural attractions, healthcare facilities, and low crime rates contribute to the overall quality of life in a region, making it more appealing to residents and businesses.

- Consumer Confidence: The confidence of local consumers and investors in the regional economy can influence real estate decisions, affecting buying, selling, and investment activities.

- Local Government Policies: Municipal policies related to zoning, land use, taxes, and development incentives can shape the real estate market. Understanding local regulations is essential for investors and developers.

- Housing Supply: The balance between housing supply and demand affects property values and rental rates. Inadequate housing supply can lead to price appreciation.

- Property Inventory: The availability of different property types, including residential, commercial, and industrial, can impact market dynamics. An oversupply of a particular property type may lead to lower values.

- Gentrification: The process of gentrification, where previously neglected neighborhoods undergo revitalization and attract higher-income residents, can result in increased property values and investment opportunities.

- Cyclical Trends: Economic cycles, including periods of economic expansion, recession, and recovery, can influence property markets. Investors may find opportunities during economic downturns when property prices are lower.

Understanding the local economic factors that influence a specific real estate market is essential for making informed decisions about buying, selling, or investing in properties. Real estate professionals, investors, and homebuyers should conduct thorough research and analysis to assess the impact of these factors on property values and market conditions in their target areas.

Interest Rates:

Interest rates play a significant role in the real estate market and can greatly influence buying, selling, and investment decisions. Here are details and insights into the impact of interest rates on the real estate market:

- Mortgage Rates: Mortgage interest rates are a crucial consideration for homebuyers. When mortgage rates are low, borrowing is more affordable, which can stimulate demand for homes and drive up property prices.

- Affordability: Lower interest rates translate to lower monthly mortgage payments for homebuyers. This increased affordability can make it easier for people to qualify for mortgages and purchase homes.

- Refinancing Activity: Low interest rates often lead to an increase in refinancing activity. Homeowners refinance their mortgages to secure lower interest rates, reduce monthly payments, or access equity for home improvements.

- Investment Decisions: Real estate investors also consider interest rates when evaluating potential investments. Low rates can enhance the returns on investment properties by reducing borrowing costs.

- Property Prices: Low interest rates can drive up property prices by increasing demand from both homebuyers and investors. As more buyers enter the market, bidding wars and competitive offers become more common.

- Housing Market Cycles: Interest rates can influence the phases of the housing market cycle. Low rates often coincide with periods of growth and rising prices, while higher rates can cool the market.

- Rental Market: Investors in the rental market may adjust rental rates based on their financing costs. Lower interest rates can allow landlords to maintain competitive rental rates or increase their profit margins.

- Housing Inventory: Fluctuations in interest rates can affect the supply of available homes. In a low-rate environment, some homeowners may choose to refinance rather than sell, reducing the inventory of homes for sale.

- Investment Alternatives: When interest rates on fixed-income investments like bonds and certificates of deposit (CDs) are low, real estate may become a more attractive investment option, potentially increasing demand for properties.

- Federal Reserve Policies: The U.S. Federal Reserve has a significant influence on interest rates through its monetary policy decisions. Changes in the federal funds rate, which affects short-term interest rates, can indirectly impact long-term mortgage rates.

- Market Sentiment: Perception of future interest rate movements can influence real estate market sentiment. Anticipation of rising rates may prompt buyers to enter the market sooner, while expectations of falling rates could lead to delayed purchases.

- Economic Conditions: Interest rates are often influenced by broader economic conditions, including inflation, employment levels, and GDP growth. Strong economic indicators may lead to higher interest rates.

- Impact on Commercial Real Estate: Commercial real estate markets are also affected by interest rates. Lower rates can lower borrowing costs for commercial property investors and encourage business expansion, potentially increasing demand for office and retail spaces.

- Regional Variations: Interest rates can affect regional real estate markets differently. Local economic factors, such as job growth and population trends, also play a role in determining how interest rate changes impact specific areas.

- Rate Locks: Homebuyers often use rate locks to secure a specific interest rate for a set period. Rate locks protect buyers from potential rate increases during the homebuying process.

Real estate professionals, investors, and homebuyers closely monitor interest rate trends and their potential impact on the market. Changes in interest rates can create both challenges and opportunities, making it essential to stay informed and adapt strategies accordingly in a dynamic real estate environment.

Property Condition:

The condition of a property is a critical factor that influences its value, appeal, and potential for both buyers and sellers. Here are details and insights into the significance of property condition in the real estate market:

- Property Value: The condition of a property directly impacts its market value. Well-maintained properties with minimal defects and a modern appearance tend to command higher prices, while properties in poor condition may sell at a discount.

- Curb Appeal: A property’s exterior appearance, landscaping, and overall curb appeal can attract or deter potential buyers. A well-kept exterior and front yard can create a positive first impression.

- Home Inspection: Buyers typically conduct a home inspection to assess a property’s condition thoroughly. The inspection can reveal issues like structural problems, water damage, electrical issues, and more. The results can influence the buyer’s decision and negotiations.

- Maintenance History: A documented history of regular maintenance and improvements can assure buyers that the property has been well cared for. It can also justify a higher asking price.

- Repairs and Renovations: Outdated or damaged features, such as plumbing, roofing, flooring, and appliances, can affect a property’s condition. Renovations and repairs may be necessary to bring the property up to modern standards and increase its value.

- Seller’s Disclosures: Sellers are often required to provide disclosures about known issues or defects with the property. Honest and transparent disclosures can build trust with buyers.

- Home Staging: Staging a property can enhance its appeal by showcasing its potential and highlighting its best features. A well-staged property is more likely to attract buyers and command higher offers.

- Financing and Appraisals: Lenders may consider a property’s condition when approving loans and conducting appraisals. Properties in poor condition may not meet lending standards, making it difficult for buyers to secure financing.

- Rental Properties: For investment properties, the condition of rental units directly affects rental income potential. Well-maintained and updated units can command higher rents and attract more reliable tenants.

- Market Competition: In competitive real estate markets, properties in excellent condition often sell faster and at better prices. Buyers have more options, and they tend to favor properties that require fewer immediate repairs or renovations.

- Renovation Costs: Buyers may factor in the cost of necessary renovations or repairs when making purchase decisions. A property in poor condition may be more attractive if the price reflects the needed investments.

- Home Warranty: Offering a home warranty can provide peace of mind to buyers concerned about potential repairs or defects after the purchase. It can make a property more appealing in the market.

- Sellers’ Investments: Sellers who invest in pre-listing inspections, repairs, and cosmetic improvements may receive a higher return on investment by increasing the property’s condition and marketability.

- Negotiations: Property condition often becomes a point of negotiation between buyers and sellers. Buyers may request repairs, credits, or price reductions based on the condition revealed during inspections.

- Legal Liability: Sellers have legal obligations to disclose known defects, and failure to do so can result in legal issues. Buyers should conduct due diligence and consider property condition in their purchase decisions.

Property condition is a critical aspect of the real estate transaction process. Both buyers and sellers should carefully assess and consider the condition of a property to make informed decisions and ensure a successful transaction.

Market Cycles:

Market cycles in real estate refer to the recurring patterns of ups and downs in property markets over time. Understanding these cycles is essential for real estate professionals, investors, and anyone involved in the real estate industry. Here are details and insights into the various phases of market cycles:

- Expansion Phase:

- Characteristics: During this phase, the real estate market experiences growth and rising property prices. Demand for properties is high, driven by factors like low interest rates, strong job markets, and positive economic conditions.

- Key Indicators: Increasing property values, declining vacancy rates, rising rental income, and a surge in construction and development activities are common signs of an expansion phase.

- Investor Behavior: Investors are optimistic, and speculative buying may occur. There is a focus on capital appreciation, and property development is robust.

- Peak Phase:

- Characteristics: The peak phase represents the zenith of the market cycle. Property prices reach their highest point, and demand remains strong, albeit with signs of slowing.

- Key Indicators: Property prices stabilize or show signs of slowing down, bidding wars become common, and new construction may reach excessive levels.

- Investor Behavior: Investors may rush to enter the market, driven by fear of missing out (FOMO). Some investors may begin to cash out or reduce their holdings.

- Contraction Phase (Correction or Recession):

- Characteristics: In this phase, the market begins to cool. Property prices may stagnate or decline, and demand starts to wane due to factors like higher interest rates, economic uncertainty, or oversupply.

- Key Indicators: Slowing property price growth, increased time on market for listings, rising vacancy rates, and a slowdown in new construction are signs of a contraction phase.

- Investor Behavior: Investor sentiment becomes cautious, and some may exit the market to avoid potential losses. Bargain-hunting opportunities may arise.

- Trough Phase:

- Characteristics: The trough represents the bottom of the market cycle. Property prices may hit their lowest point, and demand remains weak. Economic conditions can be challenging during this phase.

- Key Indicators: Declining property values, high foreclosure rates, and low buyer confidence are common indicators of a trough phase.

- Investor Behavior: Investors with a long-term perspective may begin to re-enter the market, capitalizing on lower property prices. Distressed property sales may increase.

- Recovery Phase:

- Characteristics: During the recovery phase, the market starts to stabilize and show signs of improvement. Demand gradually increases, and property prices begin to rise again.

- Key Indicators: Property prices begin to inch upward, and buyer confidence improves. Inventory levels may decrease as buyers return to the market.

- Investor Behavior: Savvy investors recognize the early signs of recovery and enter the market to position themselves for future gains. Development activity may resume cautiously.

- Stable Phase (Expansion or Growth):

- Characteristics: The market enters a stable phase characterized by balanced supply and demand, steady property appreciation, and moderate economic conditions.

- Key Indicators: Property prices show consistent but manageable growth, and rental markets remain stable. Investor confidence is high.

- Investor Behavior: Investors focus on long-term income potential and steady returns. Development activity may pick up, but with more calculated risk assessment.

Understanding market cycles is critical for making informed real estate decisions. Timing purchases, sales, and investments to align with the phases of the market cycle can help investors and professionals capitalize on opportunities and mitigate risks in the ever-changing real estate landscape. It’s important to note that market cycles can vary by location and property type, so local market conditions should always be considered.

Market Research:

Market research in the context of real estate involves gathering and analyzing data to gain insights into the local or regional property market. Whether you’re a real estate professional, investor, or homebuyer, conducting thorough market research is essential for making informed decisions. Here are details and insights into the importance and key components of real estate market research:

Importance of Market Research:

- Informed Decision-Making: Market research provides the data and analysis necessary to make informed decisions about buying, selling, or investing in real estate.

- Risk Mitigation: Understanding market trends and dynamics can help identify potential risks and opportunities, allowing stakeholders to mitigate risks and maximize returns.

- Market Timing: Research helps investors and professionals identify the best timing for entering or exiting the market, taking advantage of favorable conditions or avoiding downturns.

- Competitive Advantage: Real estate professionals can gain a competitive edge by staying ahead of market trends and offering clients valuable insights.

- Valuation: Market research is crucial for determining the fair market value of a property, preventing overpaying for purchases or underpricing for sales.

Key Components of Market Research:

- Property Data: Gather information about specific properties, including their type, location, size, condition, and recent sales history.

- Local Demographics: Understand the local population, including age groups, income levels, education, and household size, to gauge demand for housing and commercial spaces.

- Economic Indicators: Monitor economic factors like job growth, unemployment rates, GDP growth, and inflation, which impact the real estate market.

- Supply and Demand: Analyze the balance between housing supply and demand in the target area, as this can influence property values and rental rates.

- Market Trends: Track historical and current market trends, including property appreciation rates, rent trends, and vacancy rates.

- Competitor Analysis: Study the competition, including other real estate listings, development projects, and investor activities.

- Zoning and Regulations: Understand local zoning laws, land use regulations, and building codes that affect property development and use.

- Infrastructure and Development: Assess the presence of infrastructure, transportation networks, and planned development projects that can impact property values.

- Rental Market Analysis: For rental properties, research rental rates, occupancy rates, and rental income potential in the target area.

- Mortgage and Interest Rates: Keep an eye on mortgage interest rates and lending conditions, as they can influence buyer demand.

- Local Amenities: Consider the availability of amenities like schools, parks, shopping centers, and healthcare facilities, as they can enhance property desirability.

- Market Cycles: Identify the current phase of the real estate market cycle (expansion, peak, contraction, trough, recovery) to gauge overall market conditions.

- Local and National News: Stay informed about local and national news that may impact the real estate market, such as regulatory changes or economic events.

- Online Resources: Use online databases, real estate websites, government sources, and market reports to access valuable data and analysis.

- Networking: Connect with local real estate professionals, investors, and industry experts to gather insights and information about the market.

- Surveys and Focus Groups: Consider conducting surveys or focus groups to gather opinions and preferences of potential buyers or tenants in the target area.

Effective market research involves continuous monitoring and analysis of these components to adapt to changing market conditions and make strategic real estate decisions. Whether you’re a buyer, seller, investor, or professional, staying well-informed through market research is essential for success in the real estate industry.

Property History:

Property history, also known as a property’s historical background or ownership history, is a crucial aspect to consider when buying or investing in real estate. It provides valuable insights into the property’s past, which can influence its value, condition, and potential issues. Here are details and insights into the significance of property history:

1. Ownership Records:

- Property history includes a record of past and current owners, the dates of ownership changes, and the sale prices. This information can reveal how long previous owners held the property and whether they made any significant improvements or renovations.

2. Title Searches:

- Conducting a title search is a standard practice in real estate transactions. It helps identify any liens, encumbrances, or legal issues associated with the property. Clearing these issues is essential to secure a clean title.

3. Building and Renovation History:

- Property history may contain records of construction and renovation projects undertaken on the property. This information can help assess the property’s condition and determine whether any improvements were made with the necessary permits.

4. Permit and Inspection Records:

- Local government offices maintain records of building permits and inspections. These documents reveal whether work on the property was completed in compliance with building codes and regulations.

5. Property Tax Records:

- Property tax records provide details on the property’s assessed value, tax history, and any outstanding property tax bills. This information is important for budgeting and understanding ongoing financial obligations.

6. Environmental Concerns:

- Property history can uncover environmental concerns or contamination issues that may affect the property’s use or resale value. Sites with a history of hazardous materials may require remediation.

7. Neighborhood and Community Changes:

- Property history can shed light on changes in the neighborhood and community over the years. It can reveal shifts in property values, zoning changes, and local development that may impact the property’s future.

8. Historical Significance:

- Some properties have historical significance or are part of historical districts. Understanding a property’s historical background can provide insights into preservation requirements and potential limitations on renovations.

9. Easements and Right-of-Way:

- Property history may disclose the existence of easements or right-of-way agreements that grant others access to or use of a portion of the property. These can affect property use and development plans.

10. Insurance Claims and Damage Reports: – Records of insurance claims and damage reports can reveal past issues such as flooding, fire damage, or structural problems. This information is crucial for assessing the property’s condition and potential insurance costs.

11. Previous Appraisals and Inspections: – Reviewing past appraisals and inspection reports can provide insights into the property’s condition and any areas of concern that may need further investigation.

12. Boundary Disputes: – Property history may include information about past boundary disputes or property line discrepancies. Resolving these issues is essential to avoid legal complications.

13. Crime and Safety: – Researching the property’s history may uncover any past criminal activities or safety concerns related to the location.

Property history should be thoroughly researched and documented as part of the due diligence process before purchasing or investing in real estate. It helps buyers and investors make informed decisions, anticipate potential issues, and assess the property’s value accurately. Working with experienced real estate professionals and conducting comprehensive inspections is advisable to uncover any hidden aspects of a property’s history.

Legal and Regulatory Considerations:

Legal and regulatory considerations are fundamental aspects of the real estate industry that affect property transactions, development, and ownership. It’s crucial for real estate professionals, investors, and buyers to understand and comply with these legal and regulatory requirements. Here are details and insights into some of the key legal and regulatory considerations in real estate:

1. Property Ownership and Title:

- Ensuring clear and marketable title is essential when buying or selling real estate. A title search is conducted to identify any encumbrances, liens, or legal issues that may affect the property’s ownership. Title insurance is often used to protect against unforeseen title defects.

2. Zoning Laws and Land Use Regulations:

- Zoning laws and land use regulations are enforced by local governments to determine how properties can be used, the types of structures that can be built, and where they can be located. Understanding zoning regulations is crucial for property development and investment decisions.

3. Building Codes and Permits:

- Building codes specify construction standards and safety requirements for structures. Obtaining the necessary permits and complying with building codes are essential for any construction or renovation project.

4. Environmental Regulations:

- Environmental regulations aim to protect natural resources and mitigate environmental hazards. Properties may be subject to assessments for issues like hazardous materials, wetlands, or endangered species habitat.

5. Fair Housing Laws:

- Fair housing laws prohibit discrimination in housing based on factors such as race, color, religion, national origin, sex, disability, and familial status. Violations can lead to legal penalties and fines.

6. Real Estate Contracts:

- Real estate transactions are governed by contracts that outline the terms and conditions of the sale or lease. Contracts must be legally binding and may involve negotiations, contingencies, and legal disclosures.

7. Property Taxes:

- Property owners are required to pay property taxes based on the assessed value of their properties. Property tax laws and rates vary by jurisdiction and may change over time.

8. Eminent Domain:

- Eminent domain allows governments to acquire private property for public use, provided they compensate property owners fairly. Property owners have legal rights in these cases, including the right to challenge the government’s actions in court.

9. Real Estate Licensing:

- Real estate professionals, including agents, brokers, and appraisers, are typically required to be licensed and comply with state and local regulations. Licensing requirements may vary by jurisdiction.

10. Property Insurance: – Property insurance is often required by lenders and is important for protecting against property damage, liability, and loss. Insurance policies must be compliant with legal and regulatory requirements.

11. Tenant and Landlord Laws: – Tenant and landlord laws govern the rights and responsibilities of both parties in a rental agreement. These laws address issues such as lease terms, security deposits, eviction procedures, and habitability standards.

12. Condominium and Homeowners’ Associations: – Properties located within condominium or homeowners’ associations (HOAs) are subject to the rules and regulations established by these associations. Compliance with HOA rules is mandatory for property owners within these communities.

13. Licensing and Inspections: – Home inspections, appraisals, and property appraisals may be required during real estate transactions to ensure properties meet certain standards and valuations.

14. Mortgage and Financing Laws: – Mortgage lending is subject to federal and state regulations. Lenders must comply with laws related to interest rates, lending practices, and borrower protections.

15. Taxation and 1031 Exchanges: – Taxation rules and regulations for real estate transactions, including capital gains taxes and 1031 exchanges (like-kind exchanges), can have significant financial implications.

Understanding and complying with these legal and regulatory considerations is essential for maintaining the integrity of real estate transactions, protecting the rights of buyers and sellers, and avoiding legal disputes. Real estate professionals, attorneys, and experts in local regulations can provide guidance and support to navigate the complex legal landscape of the real estate industry.

Real Estate Professionals:

Real estate professionals play a crucial role in facilitating property transactions, offering expertise, and providing valuable guidance to buyers, sellers, and investors in the real estate industry. These professionals include real estate agents, brokers, appraisers, inspectors, and property managers. Here are details and insights into the roles and responsibilities of real estate professionals:

1. Real Estate Agents:

- Role: Real estate agents are licensed professionals who represent buyers and sellers in real estate transactions. They act as intermediaries, helping clients find suitable properties or buyers, negotiating deals, and guiding clients through the transaction process.

- Responsibilities: Agents assist clients with property searches, market analysis, property showings, price negotiations, and contract preparation. They also offer advice on pricing strategies and marketing plans for sellers.

2. Real Estate Brokers:

- Role: Real estate brokers are experienced agents who have obtained additional licensing and education. They can work independently or manage real estate agencies. Brokers may oversee other agents.

- Responsibilities: Brokers have the authority to handle more complex transactions, provide expert advice, and offer a higher level of guidance to clients. They are responsible for ensuring their agents adhere to ethical and legal standards.

3. Real Estate Appraisers:

- Role: Real estate appraisers determine the value of properties based on market conditions, property features, and comparable sales data. Their appraisals are crucial for establishing a property’s market price, financing, and insurance purposes.

- Responsibilities: Appraisers inspect properties, analyze market data, and prepare detailed appraisal reports. They must adhere to professional standards and ethics in providing accurate property valuations.

4. Home Inspectors:

- Role: Home inspectors evaluate the condition of residential properties to identify potential issues or defects. Their assessments help buyers make informed decisions about property purchases.

- Responsibilities: Inspectors thoroughly examine properties, including structural components, electrical systems, plumbing, HVAC systems, and more. They provide inspection reports outlining their findings and recommendations.

5. Property Managers:

- Role: Property managers oversee and manage rental properties on behalf of property owners (landlords). They handle tasks such as tenant screening, rent collection, maintenance, and property upkeep.

- Responsibilities: Property managers ensure that rental properties are well-maintained, tenants’ needs are addressed, and leases are enforced. They also handle financial aspects, including rent collection and budgeting.

6. Commercial Real Estate Brokers and Agents:

- Role: These professionals specialize in commercial real estate, including office buildings, retail spaces, industrial properties, and investment properties. Their expertise is essential for businesses and investors in the commercial sector.

- Responsibilities: Commercial brokers and agents assist clients with property acquisitions, leasing, lease negotiations, market analysis, and investment strategies tailored to the commercial real estate market.

7. Real Estate Attorneys:

- Role: Real estate attorneys specialize in legal matters related to property transactions. They provide legal advice, review contracts, and ensure transactions comply with local laws and regulations.

- Responsibilities: Attorneys help draft and review purchase agreements, leases, and other legal documents. They handle issues like title searches, zoning disputes, and property disputes.

8. Mortgage Brokers and Loan Officers:

- Role: Mortgage brokers and loan officers assist buyers in obtaining financing for real estate purchases. They work with various lenders to help clients secure mortgage loans.

- Responsibilities: These professionals assess clients’ financial situations, provide loan options, and guide them through the mortgage application and approval process.

Real estate professionals are essential in guiding clients through complex real estate transactions, ensuring legal compliance, and providing expertise in various aspects of the industry. Buyers, sellers, and investors often rely on their knowledge and experience to make informed decisions in the real estate market.

Investment Strategy:

Investment strategy in real estate involves a well-thought-out plan for acquiring, managing, and profiting from real property. It is a critical component for individuals and businesses looking to invest in real estate. Here are details and insights into real estate investment strategies:

1. Investment Objectives:

- Capital Appreciation: Investors seek properties with the potential for long-term value appreciation. This strategy focuses on buying properties in markets with expected price growth.

- Income Generation: Some investors prioritize rental income as their primary goal. They seek properties that can generate consistent cash flow through rent payments.

- Portfolio Diversification: Diversification involves spreading investments across different property types, locations, or asset classes to reduce risk.

- Wealth Preservation: Some investors use real estate as a hedge against inflation and to preserve wealth. They may prioritize properties in stable markets.

2. Property Types:

- Residential Real Estate: Includes single-family homes, condos, apartments, and vacation rentals. Residential properties often generate rental income.

- Commercial Real Estate: Encompasses office buildings, retail spaces, industrial properties, and multifamily complexes. Commercial properties can offer higher rental income and appreciation potential.

- Mixed-Use Properties: Combine residential and commercial elements. They provide the opportunity for diversified income streams.

- Specialized Properties: These include healthcare facilities, hospitality (hotels), and self-storage units, each with its unique investment characteristics.

3. Location and Market Analysis:

- Market Selection: Investors research and select markets based on factors like job growth, population trends, economic stability, and rental demand.

- Neighborhood Analysis: Within chosen markets, investors assess neighborhoods for safety, amenities, school quality, and property appreciation potential.

4. Risk Management:

- Due Diligence: Rigorous property due diligence includes inspections, title searches, and financial analysis to identify potential issues or risks.

- Financing: Investors may use conservative financing strategies to manage risk, such as lower loan-to-value ratios or fixed-rate mortgages.

5. Exit Strategy:

- Hold Strategy: Investors may opt to hold properties long-term to benefit from appreciation and rental income.

- Flip Strategy: Some investors buy properties with the intent to renovate and sell quickly for a profit.

- 1031 Exchange: Investors use this strategy to defer capital gains taxes by reinvesting proceeds from one property into another of equal or greater value.

- Passive Income: Investors may adopt a strategy focused on building a portfolio that generates passive income for retirement or financial freedom.

6. Financing and Leverage:

- Mortgage Financing: Investors can leverage mortgage loans to purchase properties with less capital upfront, potentially increasing returns.

- Cash Purchase: Some investors prefer to buy properties outright with cash to reduce debt and increase cash flow.

7. Property Management:

- Self-Management: Investors can manage properties themselves to save costs but should be prepared for hands-on involvement.

- Property Management Companies: Hiring professional property managers can help streamline operations and reduce the owner’s involvement.

8. Market Timing:

- Cyclical Timing: Investors may adapt their strategies based on where the real estate market is in its cycle—whether it’s a buyer’s market, seller’s market, or balanced market.

9. Tax Planning:

- Tax Efficiency: Investors can structure their investments to minimize tax liabilities. Strategies may include utilizing depreciation, 1031 exchanges, and tax-advantaged accounts.

10. Risk Tolerance: – Investors must assess their risk tolerance and tailor their strategies accordingly. Higher-risk strategies may yield greater rewards but also come with increased potential for losses.

Successful real estate investment requires a comprehensive strategy that aligns with investors’ goals, risk tolerance, and resources. It’s crucial to conduct thorough research, seek professional advice when necessary, and continually assess and adjust the strategy as market conditions evolve. Real estate professionals, financial advisors, and legal experts can provide valuable guidance in developing and executing an effective investment strategy.

Financial Analysis:

Financial analysis is a critical process in real estate investment that involves evaluating the financial feasibility and profitability of a property. Investors use financial analysis to make informed decisions about whether to acquire, hold, or sell real estate assets. Here are details and insights into the key components of financial analysis in real estate:

1. Property Valuation:

- Market Value: Determining the market value of the property is essential. This involves assessing comparable sales, income potential, and the property’s condition.

- Appraisal: Professional appraisers may be hired to provide an independent valuation of the property.

- Income Approach: For income-producing properties, such as rental properties and commercial real estate, the income approach estimates value based on the property’s expected income stream.

2. Cash Flow Analysis:

- Rental Income: Calculate the expected rental income by considering factors like occupancy rates, rent rates, and vacancy periods.

- Operating Expenses: Identify all operating expenses, including property management fees, property taxes, insurance, utilities, maintenance, and repairs.

- Net Operating Income (NOI): Subtract operating expenses from rental income to calculate NOI. NOI is a key metric for assessing the property’s income potential.

- Cap Rate: The capitalization rate (cap rate) is calculated by dividing the property’s NOI by its current market value or acquisition cost. It is used to evaluate the property’s potential return on investment (ROI).

3. Financing and Debt Analysis:

- Mortgage Financing: Consider the terms of mortgage loans, including interest rates, loan duration, and down payment requirements.

- Loan Amortization: Determine the monthly mortgage payments and amortization schedule to assess the impact of financing on cash flow.

- Debt Service Coverage Ratio (DSCR): DSCR measures the property’s ability to cover its debt obligations. It is calculated by dividing NOI by annual debt payments.

- Leverage: Assess the impact of leverage (borrowed funds) on returns and risk. Leverage can amplify both profits and losses.

4. Return Metrics:

- Cash-on-Cash Return: Cash-on-cash return calculates the annual pre-tax cash flow as a percentage of the initial investment or down payment.

- Return on Investment (ROI): ROI considers both cash flow and property appreciation over time. It provides a comprehensive measure of the property’s performance.

- Internal Rate of Return (IRR): IRR is a more complex metric that considers the time value of money. It calculates the annualized rate of return on an investment.

5. Risk Analysis:

- Sensitivity Analysis: Evaluate how changes in key variables (e.g., rent, expenses, interest rates) impact the property’s financial performance.

- Risk Assessment: Assess the property’s exposure to various risks, such as market fluctuations, tenant turnover, and interest rate changes.

- Exit Strategies: Consider different exit strategies, such as holding long-term, selling, or refinancing, and their potential financial outcomes.

6. Tax Implications:

- Tax Planning: Understand the tax implications of real estate investments, including depreciation benefits, capital gains taxes, and potential tax deductions.

- 1031 Exchange: Explore the option of a 1031 exchange to defer capital gains taxes when selling one property to purchase another of equal or greater value.

7. Feasibility Analysis:

- Conduct a feasibility analysis for development projects or major renovations. This involves estimating project costs, expected revenue, and potential profits.

8. Professional Assistance:

- Consider seeking guidance from financial advisors, accountants, and real estate professionals who specialize in financial analysis to ensure accuracy and thorough evaluation.

Financial analysis is an iterative process, and it’s essential to update and revisit your analysis regularly, especially when market conditions change. Accurate financial analysis is crucial for making informed investment decisions and optimizing the performance of real estate assets.

Market Trends:

Market trends in real estate refer to the patterns, shifts, and changes observed in the property market over time. Understanding these trends is essential for real estate professionals, investors, and buyers to make informed decisions. Here are details and insights into key market trends in real estate:

1. Supply and Demand Dynamics:

- Impact: The balance between housing supply and demand directly influences property prices and rental rates. An oversupply of homes can lead to price stagnation or declines, while high demand can result in price appreciation.

- Insight: Real estate professionals closely monitor supply and demand dynamics to advise clients on pricing strategies and investment opportunities.

2. Remote Work and Home Office Demand:

- Impact: The rise of remote work has increased demand for homes with dedicated office spaces, creating a shift in housing preferences.

- Insight: Property developers and sellers may capitalize on this trend by emphasizing home office features in listings and designs.

3. Urban to Suburban Shift:

- Impact: The COVID-19 pandemic accelerated a trend of urban dwellers moving to suburban or rural areas in search of larger homes and outdoor space.

- Insight: Suburban real estate markets have experienced increased demand, while some urban areas have seen softer demand.

4. Sustainable and Energy-Efficient Homes:

- Impact: Growing awareness of environmental issues and energy costs has led to increased interest in green and energy-efficient homes.

- Insight: Builders and developers are incorporating eco-friendly features and energy-saving technologies to meet this demand.

5. Aging Population and Senior Housing:

- Impact: As the population ages, there is a rising demand for senior housing options, including retirement communities and assisted living facilities.

- Insight: Investors may consider opportunities in the senior housing sector as this demographic trend continues.

6. Affordable Housing Shortages:

- Impact: Many regions face shortages of affordable housing, leading to housing affordability challenges for low- and middle-income individuals and families.

- Insight: Governments and developers are exploring ways to increase affordable housing supply through subsidies, incentives, and innovative construction methods.

7. Technology Integration:

- Impact: Technology plays a significant role in property transactions, from virtual property tours to digital mortgage applications.

- Insight: Real estate professionals and firms that embrace technology trends can enhance customer experiences and streamline processes.

8. Short-Term Rentals and Airbnb:

- Impact: Short-term rental platforms like Airbnb have disrupted traditional hospitality industries and created income opportunities for property owners.

- Insight: Investors often consider the potential for short-term rentals when evaluating property investments.

9. E-commerce and Industrial Real Estate:

- Impact: The growth of e-commerce has increased demand for logistics and distribution centers, driving the industrial real estate sector.

- Insight: Investors may explore opportunities in industrial and warehouse properties to meet the demand created by online retail.

10. Interest Rates and Mortgage Trends: – Impact: Changes in interest rates and mortgage availability influence affordability and buyer behavior in the real estate market. – Insight: Investors and buyers should monitor interest rate trends and consider their impact on property financing and affordability.

11. Social and Economic Factors: – Impact: Social and economic factors, such as job growth, population trends, and migration patterns, have a significant impact on local and regional real estate markets. – Insight: Real estate professionals and investors analyze these factors to identify markets with growth potential.

Keeping abreast of these market trends and understanding their implications is essential for making informed real estate decisions. Local market conditions can vary, so it’s important to gather data and insights specific to the region of interest and seek guidance from real estate professionals with expertise in that market.

Network:

In the context of the real estate industry, a professional network refers to the connections and relationships that individuals, such as real estate agents, investors, and industry professionals, cultivate to enhance their opportunities, knowledge, and success. Building and maintaining a robust network is essential in real estate for various reasons. Here are details and insights into the importance and benefits of a strong network in the real estate industry:

1. Access to Opportunities:

- Importance: A well-established network can provide access to a wide range of real estate opportunities, including off-market listings, investment deals, and potential clients.

- Benefits: Professionals can tap into their network to identify properties for buyers, source financing options, and discover partnership opportunities.

2. Market Knowledge and Insights:

- Importance: Real estate markets are dynamic and subject to rapid changes. Staying informed about market trends, property values, and local regulations is crucial.

- Benefits: Networking with peers, industry experts, and local professionals can provide valuable insights into market conditions and emerging opportunities.

3. Referrals and Recommendations:

- Importance: Trusted referrals and recommendations from within the network can significantly boost a professional’s credibility and business growth.

- Benefits: Real estate agents often receive referrals from other agents or industry contacts. Investors may gain access to preferred service providers, such as contractors or property managers.

4. Learning and Education:

- Importance: Real estate professionals must continually expand their knowledge to navigate a changing industry effectively.

- Benefits: Networking events, seminars, and conferences offer opportunities to learn from industry leaders, share best practices, and stay updated on industry advancements.

5. Collaboration and Partnerships:

- Importance: Collaborative efforts with other industry professionals can lead to mutually beneficial partnerships and projects.

- Benefits: Real estate investors may partner with developers, property managers, or financial experts to execute larger and more complex transactions. Agents can collaborate on co-listing properties or cross-promotion.

6. Legal and Regulatory Insights:

- Importance: Staying compliant with real estate laws and regulations is essential to avoid legal issues.

- Benefits: Networking with real estate attorneys and professionals who specialize in compliance can provide guidance on navigating complex legal matters.

7. Support and Mentorship:

- Importance: Real estate can be a challenging and competitive field. Support from peers and mentors can be invaluable.

- Benefits: New agents can benefit from mentorship programs, while experienced professionals can find a supportive community to share experiences and advice.

8. Client Trust and Confidence:

- Importance: Clients often prefer to work with professionals who have established networks and connections in the industry.

- Benefits: Demonstrating a robust network can instill confidence in clients that their interests will be well-served and that professionals have access to resources to meet their needs.

9. Geographic and Niche Expertise:

- Importance: Real estate networks often extend to specific geographic areas or property niches.

- Benefits: Networking within a particular region or property type allows professionals to develop specialized expertise and become go-to experts in their chosen markets.

10. Crisis Management and Support: – Importance: Real estate professionals may encounter challenging situations, such as market downturns or unexpected obstacles. – Benefits: A supportive network can provide guidance, resources, and emotional support during difficult times.

Building and maintaining a strong network in the real estate industry requires active participation in networking events, industry associations, and online communities. Effective networking involves nurturing relationships, offering assistance to others, and continuously expanding one’s circle of contacts. A robust network can contribute significantly to success and growth in the real estate profession.

Tham gia thảo luận